Since the COVID-19 pandemic brought unprecedented challenges to individuals and businesses across the world, the Canadian government and financial institutions have implemented various measures to provide relief to those affected financially, or simply facing financial difficulties. One such measure is the credit card payment holiday, which has been a crucial lifeline for many Canadians. The Financial Conduct Authority encouraged lenders to provide more credit card payment holidays for those struggling to make their payments during the pandemic. It is an agreement between your credit card lender and you, the borrower, to defer due payments until a later date. Although payment holidays have been a common feature of many loans and mortgages for a while, they have become more widely used due to the pandemic. In this article, we delve into what a credit card payment holiday is, how it works in Canada, and what you need to know if you are considering applying for one.

What is a credit card payment holiday?

Also known as a payment deferral, a credit card payment holiday is an agreement between a credit cardholder and their card issuer to temporarily suspend or reduce the minimum monthly payments on their credit card account. This measure is typically taken during times of financial hardship, such as a global pandemic, job loss, or other unexpected circumstances that make it difficult for individuals to meet their financial obligations. While a payment holiday may let you skip a payment, you may still pay interest. If your credit card lender is a federally regulated financial institution and they agree to a credit card payment holiday, they need to tell you if you will pay interest when skipping a payment. They will need to clearly state this when they make the payment holiday offer. You should make sure you truly understand the terms of your offer, and do not agree unless you are fully clear on what it means.

How does a credit card payment holiday work in Canada?

Here is how a credit card payment holiday typically works:

- Eligibility check – in order to be eligible for a credit card payment holiday in Canada, you typically need to demonstrate that you are facing financial challenges. This could be due to job loss, reduced income, or other financial hardships.

- Follow the application process – you should contact your credit card issuer or bank to inquire about their specific requirements and application process for a payment holiday. Most institutions have streamlined this process to make it easier for customers to request help.

- Temporary suspension or reduction of your debt – if your application is successful, your credit card issuer will temporarily suspend or reduce your minimum monthly payments. This relief can provide some much-needed breathing room for your finances during challenging times.

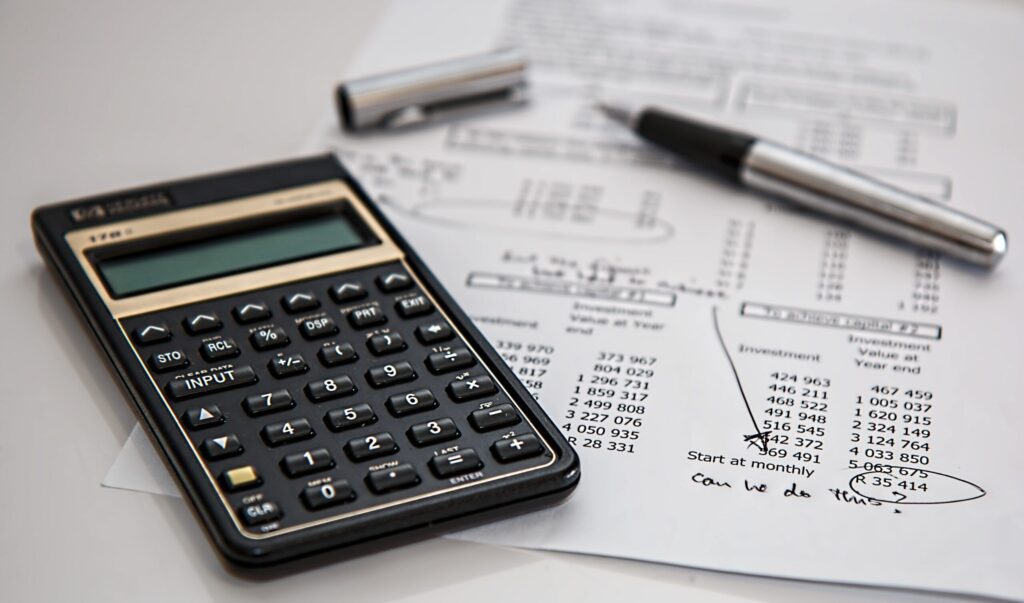

- Interest accrual – it is important to note that interest may continue to accumulate on your outstanding balance during your credit card payment holiday. This means that your overall debt may increase, even though you are not making regular payments. Make sure you clarify the terms with your lender to understand how interest will be handled.

- Temporary relief – credit card payment holidays in Canada are typically temporary measures designed to provide short-term financial relief. They are not permanent solutions, and you will be expected to resume regular payments once the agreed-upon period ends.

- Credit score impact – taking a credit card payment holiday should not directly impact your credit score. It is essential, however, to ensure that your account remains in good standing and that you continue to make any other required payments on time.

- Clear terms – always carefully review the terms and conditions of the credit card payment holiday agreement with your lender. Make sure you understand how the relief works, the duration, and any potential implications for your credit and finances.

How to apply for a credit card payment holiday

Now that the deadline for pandemic payment holidays has passed, you can only apply for a payment holiday if your original agreement allows them. Even then, you need to follow an application process, and your credit card lender may choose not to approve your application. In order to apply, you will need to check your credit card agreement to see if a payment holiday is permitted, and then reach out to your lender. If they are willing to let you have a credit card payment holiday, the key is then understanding the terms of the agreement. You will need to ask how the repayment plan will work once the payment holiday ends so that you are fully equipped. Once you have all the information you need, you can then assess the benefits of a short term solution against the increased cost in the long run.

Credit card payment holiday conditions

In some scenarios, you could be denied a credit card payment holiday, even if your credit card agreement allows for them. This could be down to a few reasons, like the following:

- A recent credit card payment missed

- You are overdue on your credit card debt payment

- You cannot prove you can make your monthly payments going forward

- You cannot prove your income

- You are in a debt management plan

- You have previously been filed bankruptcy

Payment holiday alternatives

If you do not meet the eligibility criteria for a credit card payment holiday, fear not! There are plenty of other options to help you if you need temporary relief, or more of a long term solution. Similar approaches to payment holidays include deferrals, grace periods, pausing payments for a time period, or reducing the amount you pay each month. You might also want to speak to your credit card lender to see what your options are, but do note that if they will not grant you a payment holiday, they may not be willing to explore an alternative. If your lender does agree to one of these short term solutions, it is important to note that you will need to pay more in the long term due to interest accumulation. If you are struggling to repay your credit card debt and think you need more of a drastic solution, you should book a free consultation with a Licensed Insolvency Trustee. Licensed Insolvency Trustees are the only professionals in Canada legally able to file all forms of debt relief. They are well placed to review your financial circumstances, and suggest a form of debt relief. Consumer proposals can reduce your credit card debts by up to 80% while enabling you to keep your assets, while bankruptcy offers a fresh financial future altogether.

A credit card payment holiday in Canada can be a valuable lifeline during times of financial hardship. If you want to learn more, or feel that you may need help in substantially reducing your credit card debt or eliminating it altogether, book a free consultation with Spergel. Our expert Licensed Insolvency Trustees have helped Canadians gain debt relief for over thirty years, and we are here to help you too.