Financial struggles can be overwhelming, leaving many individuals and businesses searching for a way out of debt. One viable solution for those facing unmanageable debts and financial challenges is voluntary bankruptcy. In Canada, voluntary bankruptcy provides a legal framework for debtors to address their financial difficulties and start afresh. In this article, we explain what voluntary bankruptcy is, how it works, and why it might be the right choice for you if you’re seeking relief from unmanageable debt. By understanding the process and benefits, you can make informed decisions about your financial future and regain control of your finances.

What is voluntary bankruptcy?

This process provides a structured means of handling debt and can offer a fresh financial start.

Voluntary bankruptcy is a legal process initiated by an individual or business in Canada when they are unable to pay their debts. Unlike involuntary bankruptcy, which creditors can force upon a debtor, voluntary bankruptcy is chosen by the debtor as a way to manage or eliminate overwhelming financial obligations. The process involves filing for bankruptcy through a Licensed Insolvency Trustee (LIT), who administers the process under the Bankruptcy and Insolvency Act (BIA). Voluntary bankruptcy allows the debtor to liquidate non-exempt assets to repay creditors and, upon successful completion, discharges most remaining unsecured debts, providing the debtor with a fresh financial start. Voluntary bankruptcy also offers immediate relief from collection actions through an automatic stay of proceedings, making it a structured and supportive path to resolving overwhelming financial difficulties.

What is the process of voluntary bankruptcy?

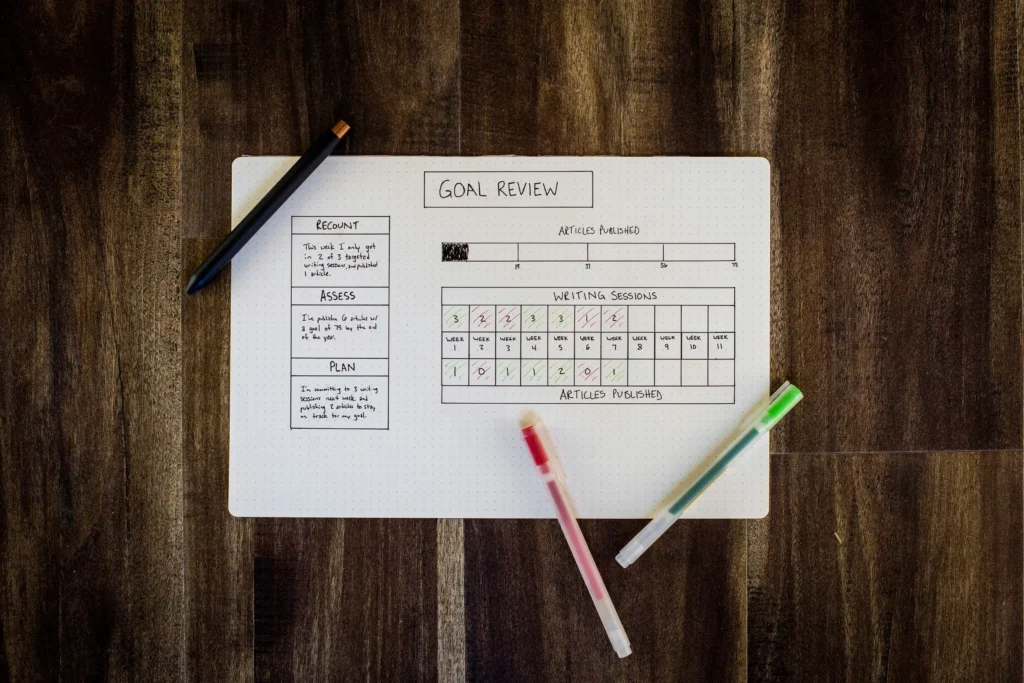

When an individual or business decides to file for bankruptcy, they work with a Licensed Insolvency Trustee who helps them navigate the process. Here are the key steps of filing bankruptcy in Canada:

- Filing for bankruptcy – the process begins when a debtor files for bankruptcy with the assistance of a Licensed Insolvency Trustee.

- Automatic stay of proceedings – upon filing, an automatic stay of proceedings is issued, which immediately halts most collection actions, including lawsuits, wage garnishments, and creditor calls.

- Asset liquidation – your trustee will assess your assets. Non-exempt assets may be sold to repay creditors. Exempt assets, such as necessary clothing and tools of the trade, are protected. Take a look at the bankruptcy exemptions by province.

- Credit counselling – debtors are required to attend two credit counselling sessions to help them understand money management and avoid future financial problems.

- Discharge: after fulfilling the bankruptcy requirements, most of the debtor’s remaining debts are discharged, releasing them from further liability. At this point, you’re free to enjoy life after bankruptcy.

What are the benefits of voluntary bankruptcy?

Here are the primary advantages of voluntary bankruptcy:

- Debt relief: one of the primary advantages of voluntary bankruptcy is the discharge of most unsecured debts, providing significant financial relief. You’ll likely be relieved from the obligation of repaying debts including credit card debt, loans, and medical bills.

- Regaining control: by voluntarily filing bankruptcy, you are more in control than you would be with an involuntary bankruptcy. This can give you more time to prepare and seek the appropriate support you might need.

- Protection from creditors: filing for bankruptcy triggers an automatic stay of proceedings, which legally halts most collection actions, including lawsuits, wage garnishments, and creditor calls.

- Fresh start: bankruptcy allows you to wipe the slate clean and start anew, free from the burden of unmanageable debt.

- Financial education: as part of the bankruptcy process, you will receive credit counselling and financial management education, equipping you with the tools and knowledge to avoid future financial pitfalls.

- Retention of essential assets: certain assets deemed necessary for living and working, such as basic clothing, household furniture, and tools of the trade, are exempt from liquidation, allowing you to retain essentials for daily life and work.

- Legal protection: the bankruptcy process is overseen by a Licensed Insolvency Trustee, ensuring that both debtor and creditor rights are respected and that the process is conducted fairly and transparently.

- Mental and emotional relief: by addressing overwhelming debt through bankruptcy, you’ll likely experience significant relief from stress and anxiety, improving your overall wellbeing and the ability to focus on rebuilding your financial health.

- No more accumulating interest: upon filing for bankruptcy, the accumulation of interest on most unsecured debts stops, preventing the further growth of debt and making it easier to manage and resolve.

Voluntary bankruptcy offers a comprehensive solution for those struggling with unmanageable debt, providing immediate relief, a path to discharging obligations, and the support needed to regain financial stability. Learn more about the advantages of bankruptcy.

What to consider before filing bankruptcy

While voluntary bankruptcy can provide relief, it’s essential to consider the following factors:

- Credit impact: bankruptcy can significantly impact your credit score and remain on your credit report for up to seven years, affecting your ability to obtain credit in the future. At Spergel, our expert Licensed Insolvency Trustees can help you to rebuild your credit score.

- Asset loss: in bankruptcy, non-exempt assets may be sold to pay off creditors, which could include valuable possessions.

- Future financial planning: bankruptcy should be viewed as a last resort. It’s crucial to consider all other debt relief options and consult with a Licensed Insolvency Trustee to explore bankruptcy alternatives.

Steps to filing voluntary bankruptcy

In Canada, a Licensed Insolvency Trustee is a key figure in the bankruptcy process. Trustees are federally regulated professionals who administer bankruptcies and consumer proposals, helping debtors navigate the complexities of insolvency. They are the only professionals in Canada legally able to file all forms of debt relief, making them well placed to assess your financial circumstances and advise you on an appropriate pathway. They guide you through the process, and ensure that your rights and those of your creditors are respected. Here are the typical steps to filing voluntary bankruptcy:

- Consultation: meet with a Licensed Insolvency Trustee to discuss your financial situation and explore your options.

- Assessment: your trustee will review your debts, income, and assets to determine the best course of action.

- Filing: if bankruptcy is the chosen path, your trustee will help you prepare and file the necessary paperwork.

- Automatic stay of proceedings: once filed, the stay of proceedings takes effect, providing immediate relief from most collection activities.

- Meeting of creditors: a meeting is held with your creditors to discuss your financial situation and the proposed plan.

- Asset liquidation: depending on your situation, non-exempt assets are liquidated to pay off creditors.

- Credit counselling: attend two mandatory credit counseling sessions.

- Discharge: upon successful completion of the bankruptcy process, remaining eligible debts are discharged, freeing you from further obligation.

What is voluntary bankruptcy? FAQs

Here are some of the most common questions we receive regarding voluntary bankruptcy:

What is the purpose of a voluntary bankruptcy?

The purpose of voluntary bankruptcy is to provide individuals or businesses overwhelmed by unmanageable debt with a structured legal process to address their financial situation and obtain debt relief. By filing for bankruptcy through a Licensed Insolvency Trustee, debtors can liquidate non-exempt assets to repay creditors and discharge most remaining unsecured debts. This process offers immediate protection from collection actions, such as wage garnishments and lawsuits, through an automatic stay of proceedings. Ultimately, voluntary bankruptcy aims to give debtors a fresh financial start, relieve stress and anxiety associated with debt, and equip them with the financial education and tools necessary to rebuild their financial health responsibly.

What is the difference between voluntary liquidation and bankruptcy?

Voluntary liquidation and bankruptcy are both processes for dealing with insolvency, but they differ in scope and application. Voluntary liquidation is a process initiated by a company’s shareholders or directors to dissolve the company and sell its assets to pay off creditors. It’s typically used when a business is insolvent or no longer viable but wishes to wind down its operations in an orderly manner. Bankruptcy, on the other hand, is a legal process that can be initiated by individuals or businesses unable to meet their debt obligations. In bankruptcy, a Licensed Insolvency Trustee administers the process, which may involve liquidating assets or setting up a repayment plan, with the ultimate goal of discharging debts and providing the debtor with a fresh start. While voluntary liquidation is specific to companies, bankruptcy can apply to both individuals and businesses.

What forms of bankruptcy are there in Canada?

In Canada, there are primarily two forms of bankruptcy available to individuals and businesses under the Bankruptcy and Insolvency Act: personal bankruptcy and corporate bankruptcy. Personal bankruptcy is designed for individuals who are unable to meet their debt obligations and involves the liquidation of non-exempt assets to repay creditors, with remaining eligible debts discharged to provide a fresh financial start. Corporate bankruptcy applies to businesses and involves either the liquidation of the company’s assets to repay creditors or restructuring efforts to allow the business to continue operations while managing its debts. Both forms of bankruptcy are overseen by a Licensed Insolvency Trustee, ensuring that the process is conducted fairly and transparently for all parties involved.

Voluntary bankruptcy is a powerful tool for individuals and businesses struggling with unmanageable debt, offering a path to financial recovery and a fresh start. It’s essential, however, to understand the implications and consider all available options before proceeding. Consulting with a Licensed Insolvency Trustee can ensure that you make the best decision for your financial future. Book a free consultation with a Licensed Insolvency Trustee at Spergel, the ‘get rid of debt’ people today.