On January 22, 2025, Canadians will come together for Bell Let’s Talk Day, an initiative designed to spark conversations about mental health. While much of the discussion often focuses on emotional and psychological wellbeing, one important aspect that deserves more attention is the profound connection between mental health and financial health. Money troubles can lead to stress, anxiety, and depression, while poor mental health can negatively impact financial decision-making and stability. A 2024 Spergel study revealed that debt load significantly impacts mental health, with respondents reporting issues such as anxiety, sleep disturbances, and strained relationships. This article explores the critical links between these two areas, providing insight and actionable strategies to achieve balance and well-being.

The impact of financial stress on mental health

Financial stress is one of the leading causes of mental health challenges in Canada. According to our study on the connection between mental health and debt, 50% of respondents reported difficulty sleeping as a result of their financial challenges. Financial stress can manifest in various ways:

- Anxiety and depression: ongoing worry about debt or meeting financial obligations can trigger chronic anxiety and depressive episodes.

- Physical symptoms: financial stress often leads to sleep disturbances, headaches, and even long-term health issues like high blood pressure.

- Strained relationships: money problems can create tension between partners, family members, and friends, further exacerbating emotional distress.

The cycle can be vicious – as mental health deteriorates, the ability to manage finances effectively often declines, deepening the financial strain.

How mental health affects financial wellbeing

Mental health challenges can significantly impact financial decision-making and stability. For instance:

- Impulsive spending: conditions like depression or bipolar disorder may lead to impulsive spending as a coping mechanism.

- Difficulty managing bills: anxiety and cognitive fatigue can make it hard to stay on top of bills and deadlines, leading to missed payments and late fees.

- Reduced earning capacity: mental health challenges can affect job performance or lead to time off work, impacting income and career progression.

Understanding these dynamics is crucial for creating strategies that address both mental and financial health simultaneously.

Building resilience: strategies for balancing mental and financial health

Achieving balance between mental and financial health requires a proactive approach. Here are some actionable steps:

- Seek professional support: if financial stress feels overwhelming, consider speaking to a Licensed Insolvency Trustee. Licensed Insolvency Trustees are the only professionals in Canada legally able to file all forms of debt relief, making them well placed to advise you on your debt. Similarly, mental health professionals can provide tools to manage anxiety or depression.

- Create a budget: a clear and realistic budget can reduce financial uncertainty and provide a sense of control over your money.

- Practice mindfulness: techniques like meditation or journaling can help reduce stress and improve decision-making.

- Access resources: take advantage of mental health and financial literacy programs, including those offered through Bell Let’s Talk and organizations like Spergel.

- Build an emergency fund: even a small savings cushion can alleviate financial stress by providing a safety net for unexpected expenses.

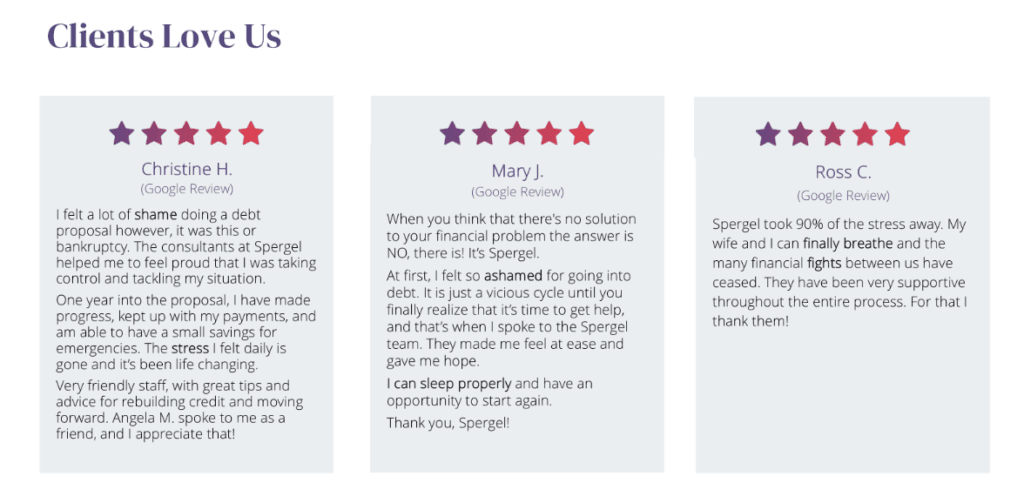

Breaking the stigma: why conversations matter

One of the most powerful aspects of Bell Let’s Talk Day is its ability to break down the stigma surrounding mental health. Similarly, financial struggles are often shrouded in shame, making it difficult for individuals to seek help. By fostering open conversations about the intersection of mental and financial health, we can create a more supportive and understanding environment. Whether you’re struggling with debt, mental health challenges, or both, know that you’re not alone. Help is available, and taking the first step – whether it’s reaching out to a friend, a professional, or a support group – can make all the difference.

Bell Let’s Talk Day 2025 is a reminder of the importance of addressing all aspects of mental health, including the often-overlooked link to financial wellbeing. By understanding the connections between these two areas and taking steps to address them, you can build a healthier, more resilient future. Spergel is here to support Canadians facing financial stress, offering tailored solutions to help you regain control and peace of mind. Join the conversation this Bell Let’s Talk Day and take the first step toward financial and mental well-being. Contact Spergel for a free, no-obligation consultation and explore how we can help you on your journey to a better future.