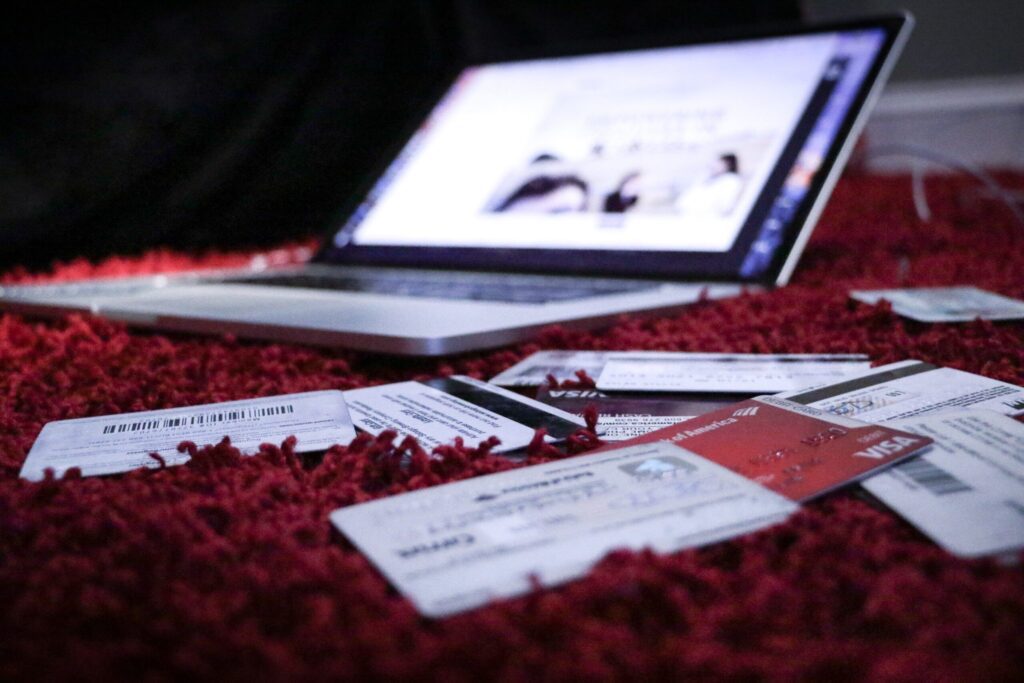

Owing tax debt can be a stressful situation, particularly if you are struggling to make your repayments. It can quickly rack up by delaying your income tax returns, or failing to pay tax on your business. Unlike other unsecured debts you may owe in Canada, including payday loan debt or credit card debt, the powers of the Canada Revenue Agency (CRA) are unrivalled. While other creditors need to gain permission from the court before taking legal action like a wage garnishment or a bank account freeze to reclaim their funds, the CRA can override this process. If you are worried about the amount of tax debt you owe, you are likely considering your available debt relief options. In this article, we explore ‘does bankruptcy clear CRA debt?’ The simple answer is yes – read on for all you need to know about filing bankruptcy on taxes.

Does bankruptcy clear CRA debt?

Absolutely – you can file all taxes you owe as part of a bankruptcy. In Canada, when it comes to legal debt relief, you can include tax debt just as you would any other type of unsecured debt. The same protection from creditors applies to the CRA too. If you are successfully discharged from bankruptcy, all your tax debt will be cleared and you are free to live life after bankruptcy. For many Canadians, bankruptcy is a last resort, but it is also one of a few different options. In Canada, Licensed Insolvency Trustees are the only professionals legally able to file all forms of debt relief. At Spergel, our experienced Licensed Insolvency Trustees have been helping Canadians gain tax debt relief for over thirty years, and we are here to help you too. We treat every individual with compassion and understanding, and will review your financial circumstances and advise you on all your available options so that you are well placed to make the right decision for you.

Options for reducing your tax debt

Before you assess your different tax debt relief options, you should complete and file all of your outstanding tax returns. Although this can feel nerve-racking, it is important to know what you owe before you can gain help. It will also provide you with the information you need to make an informed decision on the right form of debt relief for your circumstances. Here are some of the most common methods of clearing CRA debt in Canada:

Gaining tax relief

If your reason for not being able to repay your tax debts is because of circumstances outside of your control, you can apply for tax relief with the CRA. You need to provide evidence of these events, be it a natural disaster, unexpected illness, or financial hardship. If you are eligible and meet the criteria, this can allow the CRA to wave any penalties and interest. It does not, however, reduce the principal amount of the tax debt that you owe.

Filing a consumer proposal

An increasingly popular form of debt relief in Canada is filing a consumer proposal. A consumer proposal is a legal form of debt settlement in line with the Bankruptcy and Insolvency Act. It is able to reduce your unsecured debts – including tax debt – by up to 80%. It is the process of working with a Licensed Insolvency Trustee to propose an affordable monthly repayment amount to your creditors. Your Trustee will negotiate with your creditors on your behalf. If accepted, you will only need to commit to making your manageable monthly payments for a period of up to five years. Once your consumer proposal is complete, you will be cleared of any remaining tax debt. Advantages of a consumer proposal include a substantial reduction in your debt, protection from your creditors via a stay of proceedings, and the ability to keep your assets. At Spergel, we have a 99% approval rate on any consumer proposals that we file.

Filing bankruptcy

If you have a substantial amount of tax debt, or you do not meet the eligibility criteria for a consumer proposal, filing bankruptcy is likely the best pathway for you. Bankruptcy in Canada is the process of assigning any non-exempt assets you may have over to a Licensed Insolvency Trustee. In exchange, you will be cleared of your unsecured debt, including tax debt. Your non-exempt assets will be sold by your Licensed Insolvency Trustee, with any proceeds going towards the repayment of your creditor. Once the filing and administrative duties of your Licensed Insolvency Trustee are complete, your bankruptcy duties will begin. Bankruptcy in Canada typically lasts around one to two years. Provided you successfully meet the terms of your bankruptcy, you will be discharged and free to enjoy life after bankruptcy. At this point, your tax debts will be cleared for good.

If you are finding it difficult to manage your tax debt, you should try to tackle the situation as soon as you can to avoid the consequences of the CRA. Book a free consultation with Spergel. Our experienced Licensed Insolvency Trustees have been helping Canadians clear tax debt for over thirty years, and we are here to help you too. We will walk you through your options, and help you to decide the best course of action for you and your financial situation.