Achieving and maintaining financial health is a goal that resonates with many individuals and families across Canada. We go to work, we receive paycheques, and we spend our income on living expenses, housing, bills, and savings – ideally with some disposable income too. Although it may not feel like you are getting ahead in life, for many it is fine, as long as we are not falling behind. Financial health goes beyond merely having a sizeable income. It means smart money management, prudent decision-making, and a secure financial future. In this article, we explore the key signs that indicate you are financially healthy in Canada, and share how you can measure your own financial health. We also share what you can do to take charge of your financial wellbeing if needed, and the steps you can take to turn around your financial health.

What does it mean to be financially healthy?

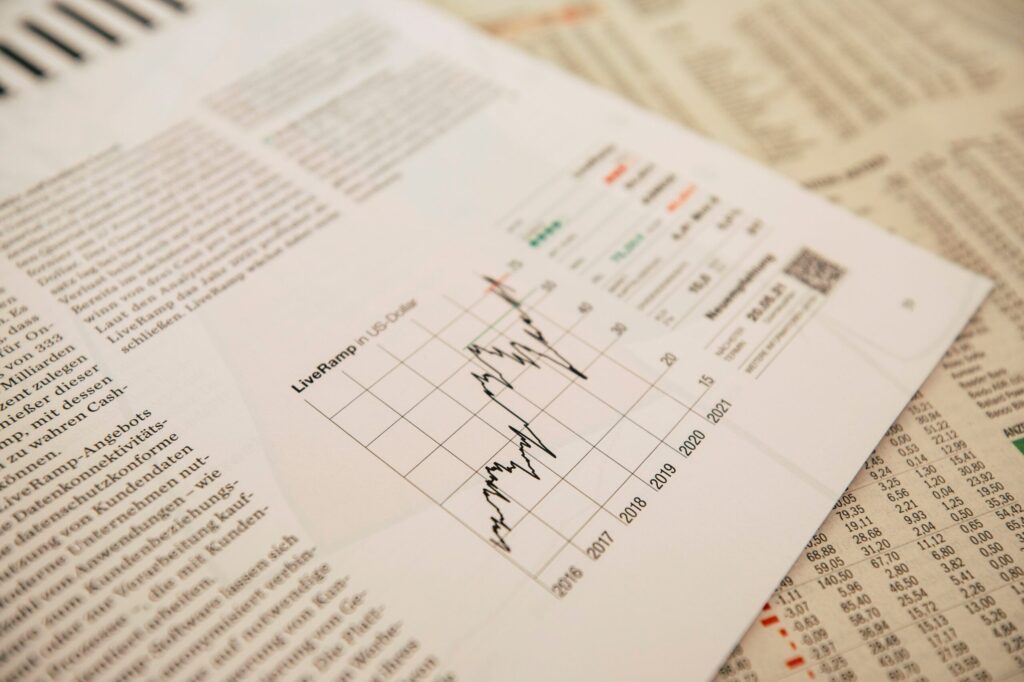

Being financially healthy cannot be pinned down to one single factor. Generally speaking, there are a few key signs of strong financial health. These include a steady income, rare changes in your expenses, strong returns on investment, and a growing cash balance. The Financial Consumer Agency of Canada has a range of resources and educational tools to help Canadians improve their financial literacy. These include tips on money management, financial assessment tools, and planning resources for saving and retirement. Good financial health does not happen quickly. It is about being consistent in your financial habits, and looking after each and every aspect of your finances to refine your habits along the way. It is good idea to first benchmark where your financial health is, and measuring your improvements in the months ahead.

What are the signs that I am financially healthy?

There are a few key signs that will help to indicate how financially healthy you are:

Having an emergency fund and savings

A key factor of having financial health is having a substantial emergency fund. This fund should cover at least three to six months’ worth of living expenses. It acts as a safety net during unforeseen circumstances such as medical emergencies, job loss, or unexpected repairs. Additionally, a strong savings habit, which includes contributions to retirement accounts, investments, and other long-term goals, is a clear sign of strong financial wellbeing.

Being able to live within your means

Living within your means essentially means spending less than you earn. If you consistently find yourself with money left over at the end of the month after paying your bills and necessities, it is a positive sign of financial health. By creating a budget and sticking to it, you will be able to track your spending, allocate funds for different purposes, and avoid picking up unnecessary debt.

Healthy debt management

While it is advisable to minimize debt wherever you can, not all debt is inherently bad. You can, for instance, have good debts too – things like mortgage and student loans that enable you to invest for the future. Financial health includes managing debts responsibly. If you have a manageable level of debt relative to your income and are making timely payments, you are on the right track.

Maintaining a good credit score

A good credit score is a reflection of your creditworthiness and financial responsibility. In Canada, credit scores range from 300 to 900, with higher scores indicating better credit management. If you consistently pay your bills on time, maintain a low credit utilization ratio, and avoid excessive credit applications, your credit score is likely to be healthy. You should check your credit report frequently, and review it for any errors.

Making frequent retirement contributions

Contributing consistently to retirement funds, such as Registered Retirement Savings Plans (RRSPs) or workplace pension plans, demonstrates foresight in planning for your future. Canada’s pension landscape emphasizes personal savings for retirement and making regular contributions an important sign of financial health. You might have even sought advice from a financial planner to set and work towards retirement goals, and understand how your financial situation might look upon retirement.

Having sufficient insurance coverage

Having adequate insurance coverage in place, including health, life, disability, and home insurance, protects you and your loved ones from unexpected financial burdens. Financial health includes having a comprehensive insurance plan in place to safeguard against unforeseen events, and can give you peace of mind.

Allowing your wealth to grow

Participating in investments that align with your risk tolerance and financial goals is indicative of financial health. While investments carry risks, a diversified and well-managed portfolio can help you to achieve long-term wealth growth and financial stability.

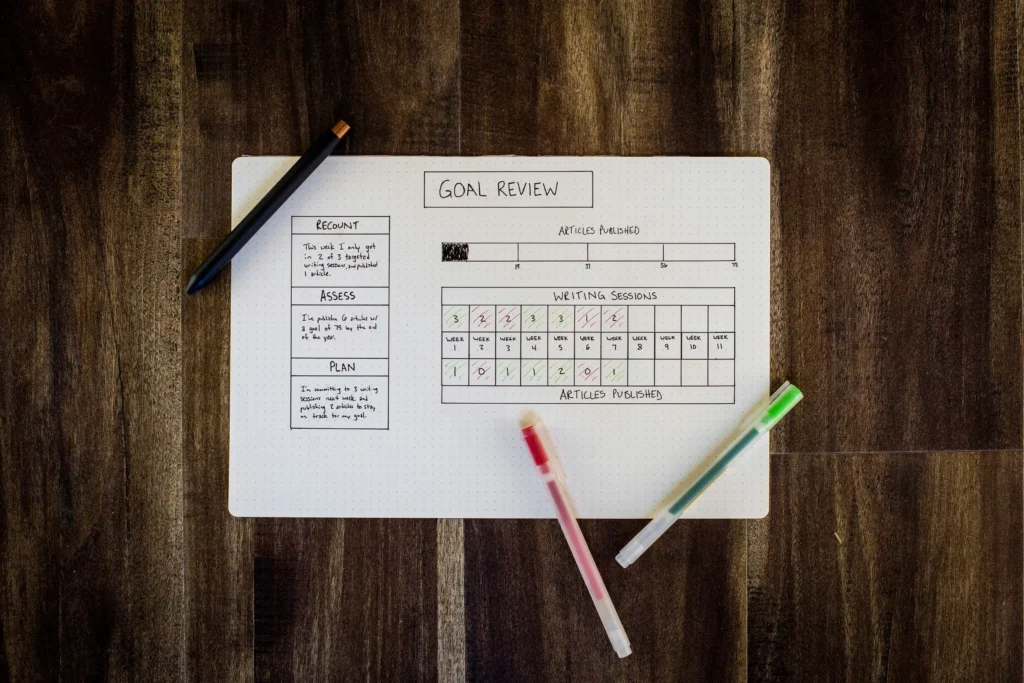

Having regular financial check-ins

Staying informed about your financial situation and regularly assessing your progress towards financial goals is a hallmark of financial health. Regularly reviewing your budget, tracking spending, and making adjustments as necessary shows a commitment to staying on top of your finances.

Not relying on credit cards

Individuals who are financially healthy do not rely on credit cards for every purchase they make. They also ensure to pay the balance off in full and on time each month, ensuring not to use expensive credit to cover any gaps in their budget. Ideally, credit cards should only be used to pay for essential expenses already planned for in your budget. If you think you would be tempted to make unnecessary purchases with a credit card, you might want to reconsider having it in your possession.

Becoming financially healthy is an ongoing journey that requires careful planning, discipline, and the right mindset. By recognizing these key signs of financial health in Canada, you can take proactive steps to strengthen your financial well-being. Use our debt repayment calculator to see how you might be able to clear any debts you have, and book a free consultation with one of our experienced Licensed Insolvency Trustees for a review of your finances and to learn about your available debt relief options.