Your credit report is a crucial reflection of your financial history, and missed payments can leave a lasting mark. Whether it’s a late credit card payment, an overdue loan instalment, or a missed mortgage payment, these financial missteps can significantly impact your credit score and overall financial health. Lenders and financial institutions use this information to assess your creditworthiness, which can affect your ability to secure loans, mortgages, and even rental agreements. If you’ve fallen behind on payments, you may be wondering ‘how long do missed payments stay on your credit report?’ The good news is that while missed payments can hurt your score, their impact diminishes over time. In this guide, we’ll explain how long these negative marks remain, how they affect your credit, and what you can do to improve your financial standing. Understanding how missed payments work can help you take proactive steps to regain control of your credit and financial future.

How long do missed payments stay on your credit report?

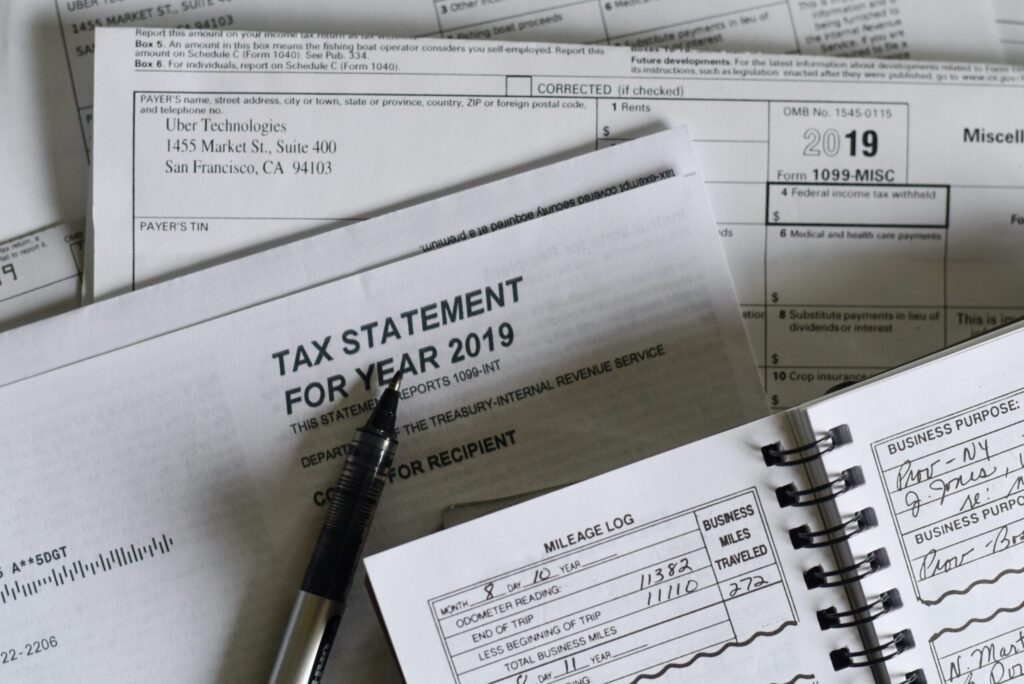

In Canada, a missed payment stays on your credit report for six years from the date of the missed payment. This applies to all types of credit accounts, including:

- Credit cards

- Personal loans

- Car loans

- Mortgages

- Lines of credit

The six-year period applies regardless of whether the payment was eventually made or if the debt was settled. However, the impact of a missed payment on your credit score lessens over time, especially if you demonstrate responsible financial behaviour afterward.

How do missed payments affect your credit score?

Your payment history is the most important factor in your credit score, making up 35% of your total score. A single missed payment can cause a drop in your score, with more significant damage if the payment remains unpaid for 30, 60, or 90 days. The longer the payment remains outstanding, the more it will impact your creditworthiness. Here’s how different late payments affect your credit:

- 30 days late: a small drop in your credit score

- 60–90 days late: a more significant impact on your credit score

- 120+ days late: the account may be sent to collections, leading to a severe credit score drop

According to Equifax Canada, younger Canadians are experiencing higher rates of missed payments. In the second quarter of 2024, approximately 1 in every 17 Canadians aged 26-35 missed a credit payment, compared to 1 in 23 for the general population. This statistic suggests that younger Canadians are experiencing greater financial strain than the general population, likely due to factors like rising living costs, student debt, and job instability. As payment history is a major factor in credit scores, this group may face greater challenges in securing future credit, loans, or mortgages.

Can you remove a missed payment from your credit report?

Missed payments cannot be removed from your credit report unless they are incorrect. If you notice an error on your report, you can dispute it with Equifax Canada or TransUnion Canada. To ensure that your credit report is accurate, check it regularly and report any discrepancies immediately.

How to rebuild your credit after a missed payment

If you’ve missed a payment, don’t panic – there are steps you can take to improve your credit score:

- Make all future payments on time – consistency is key to rebuilding your credit.

- Set up automatic payments – avoid missing payments by automating your bills.

- Reduce your credit utilization – keep your credit card balances below 30% of your credit limit.

- Consider a secured credit card – if your score has dropped significantly, using a secured credit card can help rebuild your credit.

- Seek professional help – if you’re struggling with debt, a Licensed Insolvency Trustee (LIT) at Spergel can help you explore options like a consumer proposal or bankruptcy to get your finances back on track.

How long do missed payments stay on your credit report? FAQs

Here are some of the most common questions we receive about missed payments and their impact on your credit report:

Can you have a 700 credit score with late payments?

Yes, you can have a 700 credit score with late payments, but it depends on several factors. A single late payment, especially if it’s minor (30 days late) and was a one-time mistake, may have a limited impact – especially if you have a long credit history with consistent on-time payments. However, multiple late payments or those that are 60+ days overdue can significantly lower your score. The impact also diminishes over time, so maintaining good credit habits – like paying bills on time and keeping credit utilization low – can help you rebuild and maintain a 700+ score despite past mistakes.

How long do missed payments affect your credit score?

Missed payments can have a significant impact on your credit score, with the effects lasting for several years. Typically, a missed payment will be reported to credit bureaus after 30 days, and it can lower your score by up to 100 points, depending on your credit history. These negative marks stay on your credit report for up to six years, but their impact lessens over time as you continue to make timely payments. The more recent the missed payment, the greater its effect on your score.

Is it true that after 6 years your credit is clear?

While it’s commonly believed that your credit is “clear” after six years, it’s not entirely accurate. Negative marks, such as missed payments or defaults, typically stay on your credit report for six years. This doesn’t, however, mean your credit score will automatically improve to its highest level after that period. The impact of these negative marks gradually decreases over time, but other factors, such as your current credit behaviour and outstanding debts, still play a significant role in determining your credit score. It’s important to continue managing your credit responsibly, even after these marks are removed.

How long does it take to repair credit after late payments?

Repairing your credit after late payments can take time, typically anywhere from a few months to several years, depending on the severity and frequency of the missed payments. If you have a single late payment, it may take several months of on-time payments to see noticeable improvements in your score. For more serious cases, such as multiple late payments or defaults, it can take several years to fully recover. The key is to consistently make timely payments, reduce outstanding debt, and avoid taking on new credit until your score improves. Over time, these actions can help rebuild your credit.

If missed payments are affecting your credit and making it difficult to manage debt, you don’t have to go through it alone. At Spergel, our Licensed Insolvency Trustees can help you explore debt relief solutions tailored to your financial situation. Contact us today for a free consultation and take the first step toward a fresh financial start. Because debt shouldn’t decide how you live your life.