Struggling with debt in Canada is tough. Worrying about how to pay the bills or make ends meet each week is incredibly stressful, especially if you have dependents or a family to look after. You may be worried about having your vehicle or property repossessed. Perhaps, to make things even worse, you are being harassed by collection calls or even threatened with a wage garnishment. No matter how bad you believe your financial situation to be, you must remember that there is always a way to achieve debt relief and to begin a fresh financial future. One of your first ports of call in this scenario should be to speak to a trusted Licensed Insolvency Trustee. They are the only professionals in Canada legally able to file all forms of debt relief including consumer proposals and bankruptcy. In this article, we share our top tips on how to get debt free quickly when you urgently need a fresh financial start.

How to get debt free quickly

While most people in debt agree they would love to get rid of their debt fast and once and for all, many do not know where to start. Although no single form of debt relief will work for everyone, there are plenty of options when it comes to how to get debt free quickly. The more options you can apply, the quicker you will likely get out of debt. Here are our top tips:

Pay off more than your minimum payments

When it comes to your bills or debt payments, you will need to pay off more than your minimum payments. This applies to any credit card debt, loans, and other types of unsecured debt. When it comes to how to get debt free quickly, simply paying the minimum payments will likely take you a long time to repay your debts. Often, the minimum payments on these debts will barely cover your interest rate let alone actually reducing the principal of your debt. To speed up this process, you will need to repay as much as you can reasonably afford each month.

Control your spending

Of course, it is incredibly easy to get carried away and tempted when it comes to spending. Even more so if you are using a credit card and cannot tangibly see the money you are spending, which means it can often simply be worried about later. This mentality, however, will only lead you into spiralling debt. You need to make sure you can afford everything you are spending, and keeping any available funds to go towards your debt repayment. Try paying with cash instead to reduce your spending, and track all of your spending to see where you can cut back. Learning how to budget is crucial in keeping your spending in check too.

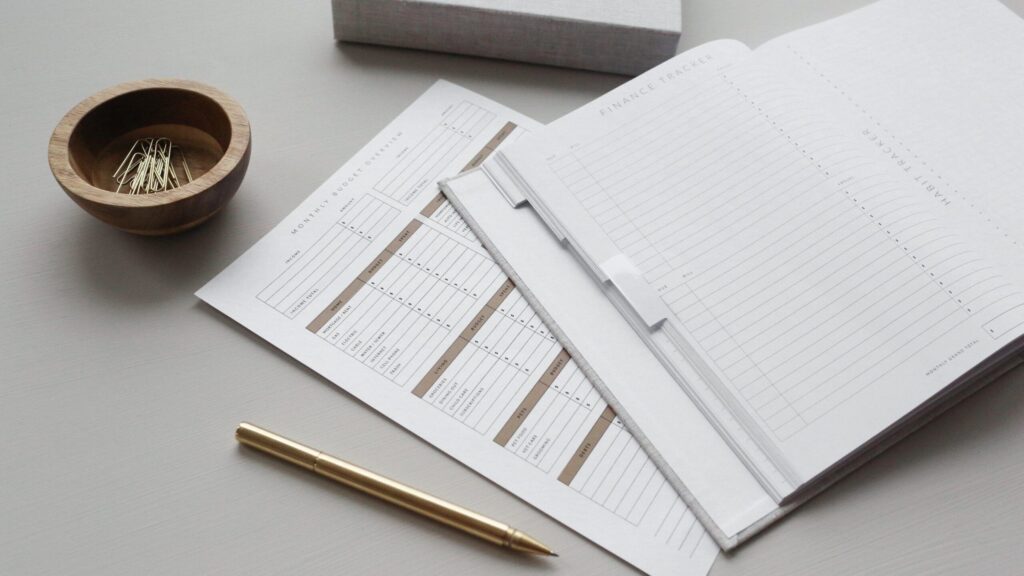

Work on repaying your most expensive debts first

It is important to be tracking your debts so that you genuinely understand your financial situation. This is the first step to getting debt free. For each debt, you should track the interest rate so you know which debt is costing you the most. For the most expensive debt, it is a good strategy to focus on making as much in the way of repayment as you can while making the minimum payments on any other debts. Once the most expensive debt is repaid in full, move onto the next most expensive debt. This is known as the snowball method, and can help to motivate you work through repaying all of your debts as quickly as possible.

Reassess your lifestyle choices

When you are crippled by debt, it is necessary to make some sensible choices about your lifestyle. This will often involve cutting back where possible. Opt for a quality used car instead of purchasing a brand new vehicle to save money. Consider reducing the number of vehicles in your household to just one and try to use public transport or walk more. Try to pull back on everyday spending where you can by being savvy with your grocery shopping. Capitalize on discounts or sales for products you would purchase anyway, and occasionally choose to eat from your stockpiled goods in order to skip a week’s grocery shopping.

Source additional income

In order to get debt free quickly, you will need to use additional funds to repay your debts as hard and fast as you can. Often, this involves picking up extra shifts at work or taking on a second job. Remember it is only a short term task for a long term gain. This will only work if you put your extra income towards repaying your debts. Once your debts are in a much better place, you can then pull back on the extra hours. You could look at earning additional funds by monetizing a hobby like handiwork, selling artwork or even babysitting or dog walking. Perhaps renting out a room in your house is an option for you too.

Refinance your mortgage

If you own a property, you may be eligible for consolidating your debts into your mortgage. This will only really be worthwhile if you have a generous amount of equity in your home, otherwise additional mortgage insurance could be expensive. If you take this pathway, you will need to commit to saving money for your debt, otherwise the situation could spiral, with temptation to keep borrowing from your home. It is best to seek advice from an impartial party or a reputable Licensed Insolvency Trustee before rushing into a decision. There may be other options that work better for you.

Consider a debt consolidation loan

If you have multiple different debts, a debt consolidation loan may be the best option for you. A debt consolidation loan is a new loan that is taken out to combine all your other unsecured debts into one. This means you often just need to make one monthly payment instead of multiple, and usually reduces your overall interest rate. In order to successfully reduce your debt with a debt consolidation loan, you should create a budget to make sure you are not overspending and are instead keeping money aside in case you need emergency funds.

Speak to a Licensed Insolvency Trustee

if you are unsure of how to get debt free quickly, you should book a free consultation with a Licensed Insolvency Trustee. Licensed Insolvency Trustees are the only professionals in Canada legally able to file all forms of debt relief. These includes consumer proposals, a popular bankruptcy alternative that reduces your debt by up to 80% while enabling you to keep your assets. A Licensed Insolvency Trustee will sit down with you to review your financial options and suggest the most appropriate form of debt relief for you. If you decide to file bankruptcy, they will walk you through the entire process and answer any questions.

If you need further advice on how to get debt free quickly, book a free consultation with Spergel. Our experienced Licensed Insolvency Trustees have helped over 100,000 Canadians become debt free through various forms of debt relief. The sooner you tackle your financial situation by seeking support, the sooner you will be on the pathway to a fresh financial future.