A Licensed Insolvency Trustee (LIT) is a federally licensed and regulated professional that provides debt relief in Canada. They are able to serve individuals and families, as well as businesses of all sizes. Spergel is a team of Licensed Insolvency Trustees, with offices across Canada. Licensed Insolvency Trustees help Canadians make informed decisions about how to best deal with their debt problems. As well as undergoing extensive training before qualification, most Licensed Insolvency Trustees have at least one additional professional designation, such as CPA (Certified Public Accountant) or CA (Chartered Accountant) certification. Choosing a debt advisor is a crucial step in your overall debt recovery. When you meet with Spergel for debt advice, we guarantee that you will meet with a fully licensed professional before we begin any form of debt relief solution. In this article, we cover what a Licensed Insolvency Trustee is and why they are an important first port of call for gaining debt relief.

What does a Licensed Insolvency Trustee do?

No matter what their background, Licensed Insolvency Trustees are experts in all kinds of debt, from payday loans to tax debt. This makes them well placed to offer unique debt relief solutions that are bespoke to each and every person they meet. In fact, they are the only professionals legally able to file all forms of debt relief in Canada. This includes two of the most common forms of debt relief, consumer proposals and bankruptcy. Licensed Insolvency Trustees have a number of key tasks as part of their roles, including the following:

- Meeting with you to review your debts and financial circumstances

- Helping you to consider and understand all of your debt relief options

- Collecting information from you, preparing the official documents, and filing the necessary paperwork with the government

- Acting as mediators to help you negotiate debt settlements with your creditors in a fair manner for both parties

- Ensuring the amount of debt you pay back is affordable for you

- Making sure the amount you pay back is enough to satisfy your creditors

- Complying with the government laws laid out in the Bankruptcy and Insolvency Act throughout the process

- Notifying your creditors that you have filed a form of debt relief

- Stopping collection calls and legal threats including wage garnishments

- Dealing with any assets not exempt from seizure in a bankruptcy

- Helping you learn more about how to budget, credit counselling, and managing your money

- Applying for your completion certificate or discharge so you can be officially discharged from your debts

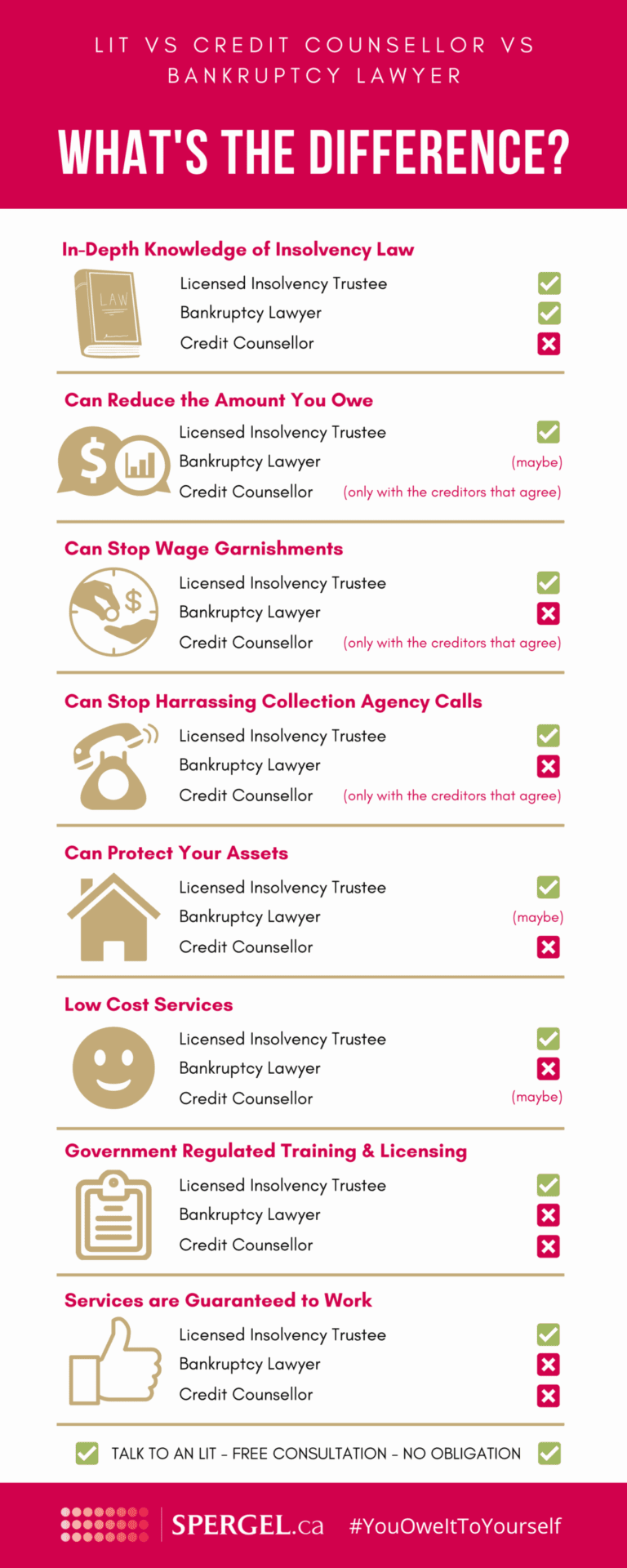

Licensed Insolvency Trustees are not to be confused with bankruptcy lawyers or credit counsellors. By comparison, bankruptcy lawyers are lawyers who specialize in insolvency law. They often practice insolvency law deals with corporate insolvency, advocating for a creditor or business. Bankruptcy lawyers are not professionals able to file forms of debt relief on your behalf – instead, you need a Licensed Insolvency Trustee. Equally, credit counsellors cannot represent you in court or file insolvency proceedings. They have to refer their clients to a Licensed Insolvency Trustee for consumer proposal and bankruptcy services when their own debt management strategies are insufficient. See the infographic below for the key differences between Licensed Insolvency Trustees, credit counsellors, and bankruptcy lawyers. At Spergel, unlike other bankruptcy firms, you are assigned your very own Licensed Insolvency Trustee who will walk you through the entire debt relief process, instead of passing you from person to person.

Why should you consult a Licensed Insolvency Trustee?

If you are looking to file a form of debt relief or simply need advice on managing your debts, a Licensed Insolvency Trustee should be your first port of call. They are the only professionals in Canada legally able to file all forms of debt relief, and are therefore well placed to support you on your journey to financial freedom. Here are some other reasons why you should consult a Licensed Insolvency Trustee:

To receive qualified debt advice

Licensed Insolvency Trustees are incredibly highly trained and educated professionals. Almost all Licensed Insolvency Trustees in Canada have an accounting qualification as well as a university degree. They must pass rigorous bankruptcy and law courses, and are investigated by the RCMP before receiving their licenses. This means you are receiving the best possible advice for handling your debts and seeking debt relief.

To learn more about your full range of debt relief options

Many debtors will assume that their only debt relief option is bankruptcy, but this could not be further from the reality. Some will instead file a consumer proposal, and others will work on other solutions that may be appropriate for them, like a debt consolidation loan. Licensed Insolvency Trustees will educate you on all of your options with authority, and help you to make a decision on the right solution for you.

For a free, no-obligation consultation

Most Licensed Insolvency Trustees will offer a free, no-obligation consultation to review your options when it comes to debt relief. It is an opportunity for some free advice on your unique financial circumstances, without pressure. There is nothing to lose by simply finding out more from an expert in the field. They are here to answer any questions you may have about how to file a bankruptcy or how to file a consumer proposal.

To gain a form of debt relief that is cheaper than alternative options

Often, it will be more affordable to work with a Licensed Insolvency Trustee than working with other debt consultants. For instance, a debt management plan via a credit counselling agency will require you to repay 100% of your debts. Alternatively, filing a consumer proposal could mean you reduce your debt by up to 80%, inclusive of Licensed Insolvency Trustee fees.

For full protection and regulation

As Licensed Insolvency Trustees are fully regulated by the federal government, you can rest assured. They must follow a code of ethics, and there are processes already in place for the mediation of any disputes you may have. Licensed Insolvency Trustees also undergo ongoing oversight by the Office of the Superintendent of Bankruptcy and therefore must adhere to a certain level of practice. Their fees are also regulated by the federal government.

For guidance throughout the debt relief process

As the only professionals legally able to file all forms of debt relief in Canada, Licensed Insolvency Trustees are experts in guiding debtors through their chosen debt relief solution. Filing a consumer proposal or bankruptcy can be a complicated process, but Licensed Insolvency Trustees will help make the process as simple as possible for you, decoding any jargon. They will help to manage the process efficiently and quickly, answering any questions you may have.

To deal with your creditors on your behalf

One of the primary advantages of filing either a consumer proposal or a bankruptcy is a stay of proceedings. Automatically generated upon filing, it will offer full protection from your creditors, and will stop any legal threats or wage garnishments. It also means your Licensed Insolvency Trustee will handle your creditors for you, acting as a buffer and negotiating on your behalf. It means the immediate end of relentless and often harassing collection calls.

Can a Licensed Insolvency Trustee reduce my debt?

Absolutely. In fact, a large part of their role is advising on how you can reduce your debt or clear it completely. At the very least, your Licensed Insolvency Trustee will negotiate with your creditors which can typically remove at least some of the interest fee you are charged on the funds you borrowed. Interest fees can quickly accumulate, so this can often be quite a relief. Licensed Insolvency Trustees will always consider your financial circumstances and recommend the most appropriate form of debt relief for you. Your repayment plan will always be one that is manageable for you to make, to allow you to begin the journey to the fresh financial future that you deserve. They will also try to help you to keep your assets including your house and car if you decide to file for bankruptcy.

Which kinds of debt can Licensed Insolvency Trustees support with?

No matter what your financial circumstances, or the type of debt you owe, Licensed Insolvency Trustees are there to support you with all kinds of debt. This is inclusive of:

- Credit card debt

- Tax debt

- Student loan debt

- Personal debt, including payday loans

- Business debt

What happens when you meet with a Licensed Insolvency Trustee?

When you meet with a Licensed Insolvency Trustee, they look at all of the types of debt you have and your financial circumstances. They will then review all of the debt relief options available to you, and assess the best way for you to manage them. This is usually done with one of the two debt relief plans available to individuals under the Bankruptcy and Insolvency Act – consumer proposals and bankruptcies.

- A consumer proposal enables you to pay back a portion of your debt without interest, and/or over a longer period of time. This type of debt help freezes interest and penalties, while allowing you to keep your assets. This makes it a viable solution for high-interest credit card debt.

- A bankruptcy works much faster. In as little as nine months, you can have a financial fresh start. This plan offers relief from wage garnishments and nearly all types of debt. Plus, your trustee will help you to manage your obligations over that nine month period to ensure you complete the process successfully.

Whether it’s a consumer proposal or a bankruptcy, your Licensed Insolvency Trustee will be by your side every step of the way. They will also make sure you understand your legal obligations and the consequences of not meeting those obligations, so that you are not met with any unpleasant surprises.

How can a Licensed Insolvency Trustee support me if I am a small business owner and am overwhelmed by debt?

Licensed Insolvency Trustees are well-versed in different corporate models and can help businesses of all sizes through restructuring and debt settlement processes. In consultation with you and your partners, your Licensed Insolvency Trustee will devise the best debt settlement strategy for you and your business needs. They can also help you do the math to decide whether it is better to continue running your business with a new strategy or simply to close it down.

At Spergel, our job is to give you a fresh financial start. Over 100,000 Canadians have trusted us to provide the best debt relief support in the country. The process starts with a free, confidential consultation. No matter what your situation, our experienced Licensed Insolvency Trustees provide debt relief quickly to give you the peace of mind you need to move on with your life. Book a free consultation with us today – you owe it to yourself.