Across Canada, rent increases are straining household budgets and forcing families to make tough financial choices. In many cities, the cost of renting has risen faster than wages, making it harder to afford basic living expenses – let alone get ahead.From diapers to daycare, hockey gear to university tuition, the cost of raising a child in Canada averages of $293,000, according to Statistics Canada. For many parents, debt becomes a necessary but stressful part of the equation. If you’re feeling the financial pressure of parenting and debt, you’re not alone. At Spergel, we’ve helped over 100,000 Canadian families navigate the challenges of debt. Here’s how to stay financially afloat while giving your kids the future they deserve.

The real cost of raising a child in Canada

According to MoneySense and Statistics Canada, the average cost of raising a child from birth to age 18 ranges between $16,900 to $17,235 per year – not including post-secondary education.

Common costs include:

- Childcare: full-time daycare can cost between $8,000 – $20,000 annually per child, depending on your province.

- Housing: growing families often need more space, leading to higher rent or mortgage payments.

- Food and clothing: Kids grow fast, and so do your grocery and clothing bills.

- Education and activities: sports, music lessons, school supplies – they all add up.

When these costs collide with other financial pressures like credit card debt, student loans, or rising interest rates, even the most budget-conscious families can find themselves overwhelmed.

Why parents fall into debt

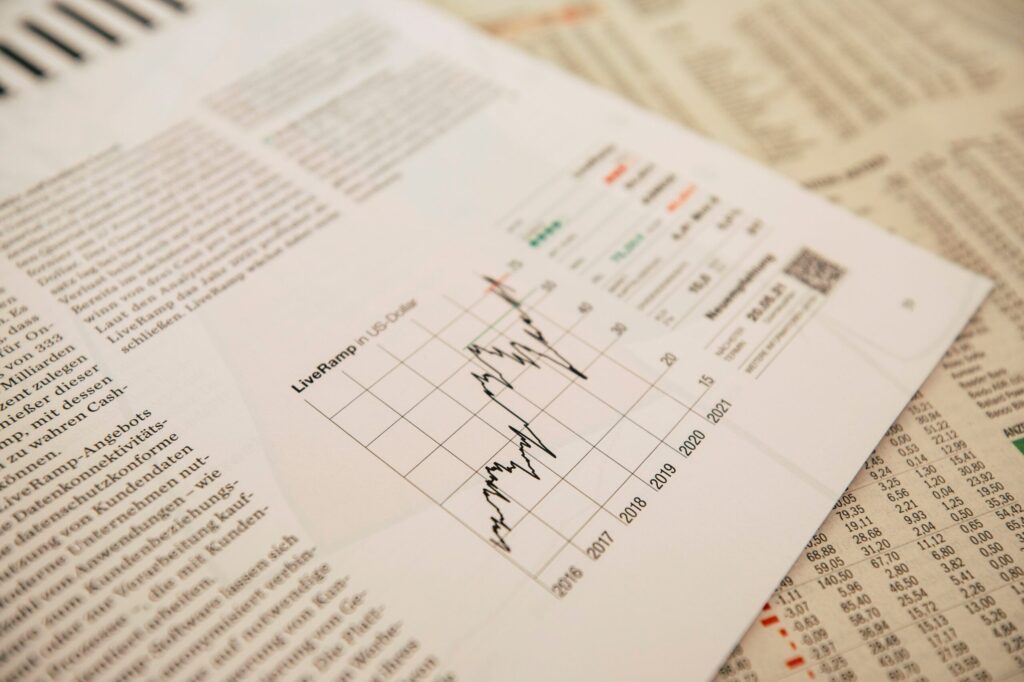

Many Canadian parents rely on credit to manage growing household expenses. In recent years, household debt in Canada hit record highs, with credit card debt being a major contributor.

Common debt traps for parents include:

- Overspending on non-essential “kid” items

- Relying on credit for day-to-day expenses

- Using payday loans or high-interest financing

- Losing income during parental leave

- Underestimating childcare costs

How to manage parenting costs without drowning in debt

Parenting comes with countless joys – and just as many expenses. From unexpected bills to everyday essentials, it’s easy to feel like you’re constantly playing financial catch-up. The good news? With the right strategies and support, you can stay in control of your money while still giving your kids what they need. Here’s how to ease the pressure and make every dollar count.

1. Create a family budget

Start by tracking your spending – you can use our FREE Spending Tracker for this. Include all monthly essentials, from diapers and groceries to bills and daycare. You might also wish to use a Budget Template to categorize expenses and identify areas where you can cut back.

2. Prioritize needs over wants

There’s pressure to give your child the best – but “the best” doesn’t always mean “the most expensive.” Focus on essentials and find joy in experiences rather than things.

3. Build an emergency fund

Even saving a few hundred dollars can make a difference when it comes to an emergency fund. A small buffer can help you avoid relying on credit cards for unexpected expenses like car repairs or medical bills.

4. Look for government support

Explore Canadian benefits for parents:

- Canada Child Benefit (CCB)

- Childcare Subsidies (varies by province)

- GST/HST Credit

These can provide thousands in tax-free support annually.

5. Tackle high-interest debt first

If you’re juggling multiple debts, prioritize paying off the ones with the highest interest rates – typically credit cards and payday loans. You might consider using the debt snowball, debt avalanche, or debt snowflake methods to help you do so.

6. Seek professional help early

If you’re only making minimum payments or using one card to pay another, it’s time to speak to a Licensed Insolvency Trustee. Licensed Insolvency Trustees are the only professionals in Canada legally able to file all forms of debt relief.

How Spergel can help

At Spergel, we know that parenting and debt can feel like a constant juggling act. Whether you’re behind on bills, maxed out on credit, or worried about your family’s financial future, our experienced Licensed Insolvency Trustees can help. We offer:

- Free, no-obligation consultations

- Debt relief options, including consumer proposals and bankruptcy alternatives

- Personalized plans tailored to your family’s unique needs

Final thoughts: you’re not failing – it’s just expensive

Parenting in Canada today comes with high costs – financially and emotionally. Debt doesn’t mean you’re failing. It means you’re human. With the right guidance, budgeting habits, and support systems, you can stay afloat – and even thrive – while raising your children. And when things feel out of control, know that Spergel is here to help.

Need help managing parenting and debt? Book a free consultation with one of Spergel’s Licensed Insolvency Trustees today. You don’t have to do this alone.