Bankruptcy is an important form of debt relief in Canada, and offers a fresh financial future for those who need it. It is the process of assigning any non-exempt assets over to your Licensed Insolvency Trustee. Any proceeds from the sale of these assets will go towards repayment of your creditors, and in exchange you will be cleared of any unsecured debts you file. You receive full protection from your creditors, including the end of any activity including wage garnishments and collection calls. While many Canadians think that bankruptcy leaves you with nothing, this is not the case – you can keep a number of essential assets up to a certain value threshold, depending on your province of residence. While we know what bankruptcy means, many Canadians often wonder ‘what happens after you file bankruptcy?’ In this article, we explain what happens after you file bankruptcy, and all you need to know about the process.

How do you file for bankruptcy?

The first step to filing bankruptcy is appointing a reputable, experienced Licensed Insolvency Trustee. Licensed Insolvency Trustees are the only professionals in Canada legally able to file all forms of debt relief, and so can give you professional advice on what may be the best option for you and your financial situation. At Spergel, we have been helping Canadians to file bankruptcy for over thirty years. With your Licensed Insolvency Trustee, together you will review your financial circumstances. Your trustee will share any available debt relief options to you, and they will explain them in detail so that you are well informed. This will usually include options including debt consolidation loans, consumer proposals, and a number of other bankruptcy alternatives. You may decide that none of the alternatives are quite right, and that you want to file bankruptcy for a fresh financial future. Your Licensed Insolvency Trustee will walk you through the entire process in detail. At Spergel, unlike other bankruptcy firms, you will be assigned your own Licensed Insolvency Trustee to walk you through your entire debt relief journey, instead of passing you from person to person.

What happens after you file bankruptcy?

Your Licensed Insolvency Trustee will prepare and file the necessary paperwork for filing bankruptcy. Once filed, a stay of proceedings is generated which means an end to any collection calls and legal action including wage garnishments, placement of liens, and bank account freezes. The bankruptcy process itself lasts between 9 and 21 months usually for any Canadians filing bankruptcy for the first time. Your Licensed Insolvency Trustee will distribute the relevant funds accordingly to your creditors from any non-exempt assets you may have, and from income where appropriate. You will have a few duties to carry out as part of the bankruptcy process:

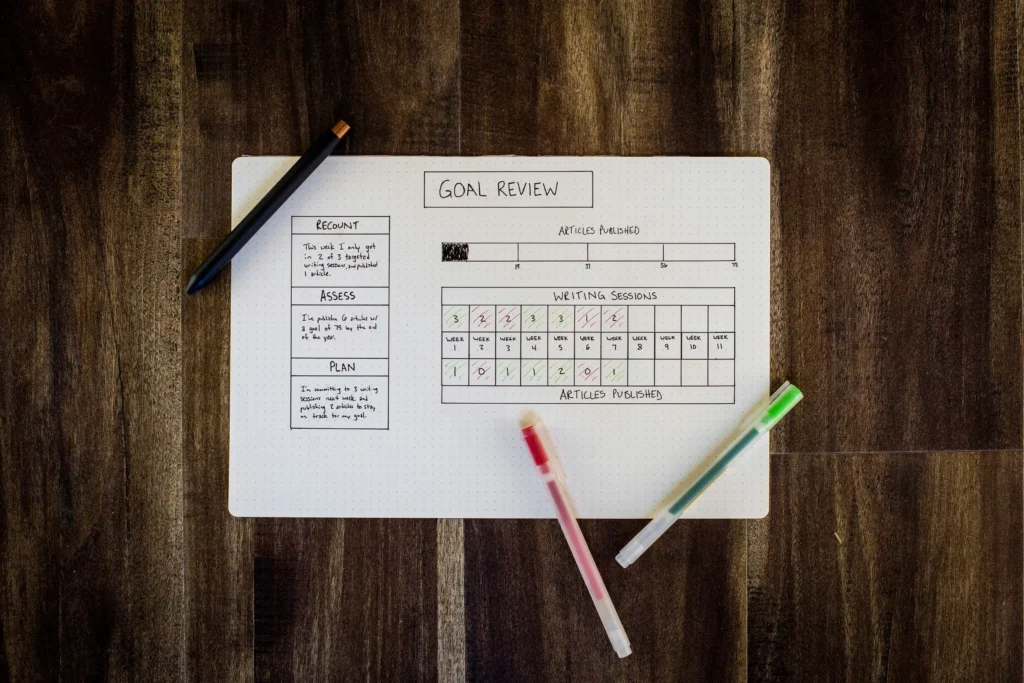

- Sharing your monthly income and expense reports with your Licensed Insolvency Trustees to ensure your budget is in line with the bankruptcy plan, and there is no surplus income

- Attending two credit counselling sessions to assist with your money management skills including budgeting, tracking expenses, and rebuilding your credit score

- Sharing any tax information with your Licensed Insolvency Trustee so that your tax returns can be filed and prepared

- Make any required payments like surplus income or costs for re-purchasing any non-exempt assets or fees to your Licensed Insolvency Trustee

If you have taken all the required steps and fulfilled your bankruptcy duties, you will be discharged of your debts between 9 to 21 months.

What happens to your income after you file bankruptcy?

Thankfully, bankruptcy will not directly impact your income. All you need to do as part of your bankruptcy obligations is share your household monthly income and expenses with your Licensed Insolvency Trustee. If you get a pay rise, gain additional income, or lose a member of your household, again you will need to let your Licensed Insolvency Trustee know. If your income exceeds the threshold for your household size, you may need to make surplus income payments. This is essentially a cost for earning over the expected cost required to maintain a reasonable standard of living, based on the amount of people in your household. The surplus income threshold is determined by the Office of the Superintendent of Bankruptcy.

Can you keep your bank account after filing bankruptcy?

If you have $1,000 or more in your bank account and would like overdraft protection, you need to inform your bank that you are filing bankruptcy. It is a good idea to open a new bank account at a different financial institution where you do not owe money, so that your creditors cannot access your funds. You should only use this new bank account instead of any accounts you had prior to filing bankruptcy.

Life after bankruptcy

Once you are discharged from bankruptcy in Canada, you are free to enjoy life after bankruptcy. It is at this point that you are cleared of your unsecured debts, and completely free to enjoy a fresh financial future. As well as being a huge weight from your shoulders, bankruptcy can help to free many of the mental health problems associated with overwhelming debts. Your journey with Spergel does not end at discharge from bankruptcy. Our experienced Licensed Insolvency Trustees are here to help you, and can advise you on rebuilding your credit report. We can support you on gaining a mortgage after bankruptcy, securing a car, or getting credit after bankruptcy. We can help you with strategies to restore your credit rating long term, too.

Want to know more about what happens after your file bankruptcy? Book a free consultation with one of our experienced Licensed Insolvency Trustees at Spergel. We will help you to review your options so that you can make an informed decision about either filing bankruptcy or an alternative debt relief option. We will make sure you are empowered to make the right decision for you. Reach out today – you owe it to yourself.